Because in practice, things can and do go sideways for companies, making a standard like ASC 250 an absolute necessity. I want to highlight a key point here… “an entity develops an accounting estimate to achieve the objective set out by the policy.” Luna’s policy (FVPL) is achieved by the use of an estimate (the measurement technique to arrive at fair value). Still, it’s important to consider the existence of mitigating controls and whether they are precise enough to prevent or detect a potential material misstatement. Keep in mind, when a restatement occurs, an accompanying material weakness or multiple material weaknesses are almost always a certainty. That’s the territory where ASC 250 exists, providing much-needed guidance on what to do when an accounting change or reporting error pops up. Therefore, although this particular accounting standard isn’t exactly an area CFOs enjoy, knowing the lay of the land is still essential.

form.onSubmit(function()

That said, whenever the FASB issues a codification update, it typically includes transition guidance describing the applicable adoption methods. However, in the rare cases when the FASB doesn’t provide such guidance, companies must adopt an accounting change to adhere to the updated standard. In 2024, the Securities and Exchange Commission (SEC) issued its highly anticipated climate change disclosure rules.

A No-Fear Guide to Your Upcoming Financial Statement Audit

Changing an accounting principle is different from changing an accounting estimate or reporting entity. Accounting principles impact the methods used, whereas an estimate refers to a specific recalculation. An example of a change in accounting principles occurs when a company changes its system of inventory valuation, perhaps moving from LIFO to FIFO.

if (t.invoked) return void (window.console && console.error && console.error(«Drift snippet included twice.»));

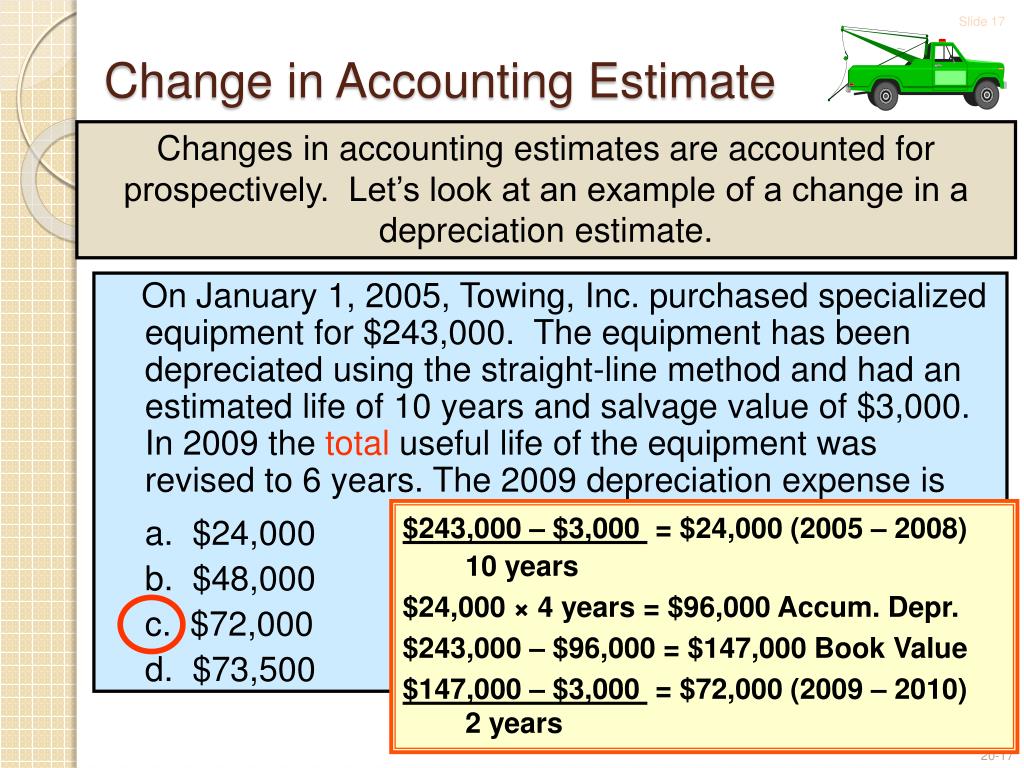

- A change in accounting estimate is not accounted for by restating or retrospectively adjusting amounts reported in previously issued financial statements or by reporting pro forma amounts for prior periods.

- Materiality assessments aren’t standardized for all entities, so different factors will influence their outcome.

- However, some private companies may consider changing an accounting principle – for example, a private company alternative – to one required for public companies before filing an IPO registration statement.

- Further, the company only presents two fiscal years of comparative financial statements and found no other errors.

- Since these types of changes relate to the continuing process of obtaining additional information and revising estimates, they are considered a change in estimate.

- There are cases where a retrospective application doesn’t have to be made, which includes having made all reasonable efforts to do so, which can include not being able to make subjective significant estimates or having to have knowledge of management’s intent.

Like all control deficiencies, management would need to determine if it should characterize it as a significant deficiency or material weakness. BDO USA, P.C., a Virginia professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO supports the Board’s proposals to refine the derivatives scope exception and to clarify that an entity should apply the guidance in ASC 606 to a share-based payment from a customer as consideration in a revenue contract. The first three categories above represent “accounting changes.” In order to understand the accounting and disclosure obligations for each of these categories, it is helpful to begin with a basic understanding of their meaning. Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year.

Just because an overlap between changes in estimates and changes in accounting principles might exist doesn’t mean the accounting treatments are the same between the two. In other words, you would retrospectively adjust the amounts reported in prior period financial statements. The correction of a misstatement change in accounting principle inseparable from a change in estimate related to interim periods of a prior fiscal year requires the same presentation and disclosures as the approaches discussed above. Additionally, an entity will need to consider the impact of such errors on its internal controls over financial reporting – refer to Section 4 below for further discussion.

How Should a Change in Accounting Principles Be Recorded and Reported?

When an entity files an IPO registration statement, it must change its accounting principles to meet the requirements for public companies. Since this type of change isn’t voluntary, the entity doesn’t have to evaluate whether the change is preferable. Audit standards also require the auditor to assess the impact of identified errors on any previously issued opinions on a registrant’s internal controls over financial reporting, which may ultimately require the reissuance of the opinion in certain circumstances. It is important to distinguish the treatment from a change in accounting principle, as defined above, from a change that results from moving from an accounting principle that is not generally accepted to one that is generally accepted. Accountants use estimates in their reports when it is impossible or impractical to provide exact numbers. When these estimates prove to be incorrect, or new information allows for more accurate estimations, the entity should record the improved estimate in a change in accounting estimate.

The definition of a change in accounting policy was removed but the explanatory paragraphs were retained. The rollover method assesses income statement errors based on the amount the income statement for the period is misstated – including the reversing effect of any prior period errors – as well as any identified misstatements in the previous period that were not corrected. Note that many companies evaluate the error or errors relative to the totals and subtotals of all the statements, thinking about materiality in relation to the financial statements as a whole. Regarding accounting estimates, management must understand the significant assumptions, methods, data, and controls pertaining to estimates and how those controls can quickly identify necessary changes in their assumptions, methods, and data. Note our use of the word quickly – timely performance of controls of an estimation process is critical in this area.

In these cases, a company must reflect the cumulative effect of the change to the new accounting principle on prior periods via the carrying amounts of assets and liabilities as of the beginning of the first period presented. If applicable, the reporting makes any offsetting adjustment to the opening balance of retained earnings for that period. The SEC staff has provided its view that the first checkbox should be checked when the financial statements reflect the correction of an accounting error, as defined in GAAP (or IFRS), in the previously issued financial statements. The SEC staff indicated that voluntary restatements include corrections of immaterial errors in the financial statement footnotes. However, the first checkbox is not required to be checked for any out-of-period adjustments that are recorded in the financial statements of the current period. Once the entity has identified an error, whether material or immaterial, the entity should consider whether and how the identified error affects the design and effectiveness of the entity’s related internal controls.

This question has been a source of frustration for years under IFRS (and U.S. GAAP too!). The IASB realized help was needed and published amendments to IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors in 2021. First and foremost, if you are an SEC registrant that restates and reissues financial statements to correct a material error, the SEC requires you to file a timely Form 8-K and meet other applicable requirements under Regulation S-K. Likewise, you would also need to file an amended form – 10-KA, for example – to reflect these changes, in addition to the 8-K. The revision process differs from restatements in that reissuance isn’t as critical since the prior period statements aren’t materially misstated. Put another way, a private company could justify the change if it meant moving to a more preferred approach, but not the other way around.